The Unexpected Winners of the 125% China Tariff: U.S. Robotics Manufacturers

In our rapidly evolving global economy, one thing has become crystal clear: location matters more than ever for robotics manufacturing. The sweeping new tariffs have completely reshuffled the competitive landscape for robotics companies—making strategic decisions to conduct parts of the manufacturing process in America go from a risky bet to an absolute win!

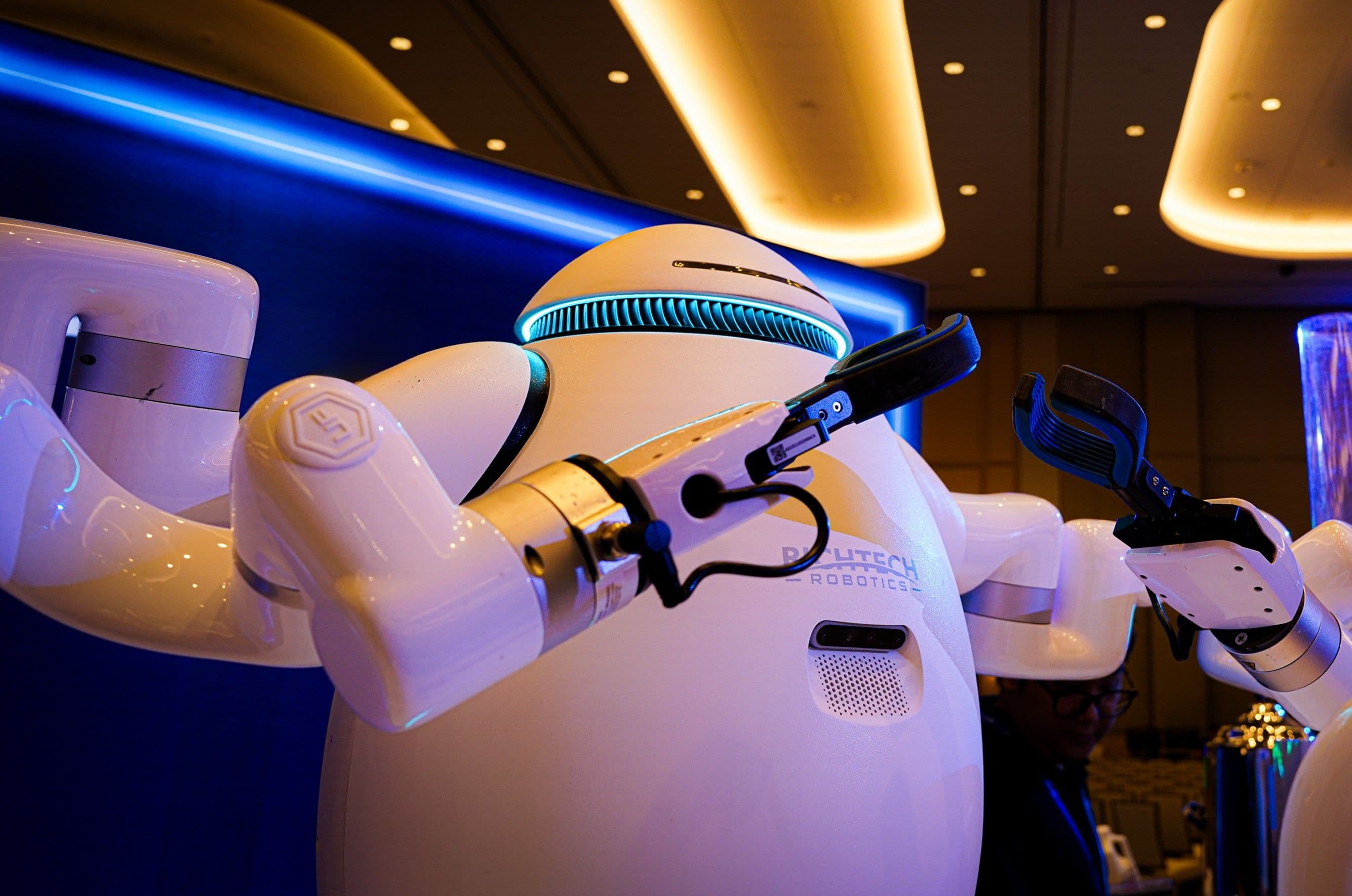

Implementing a staggering 125% tariff on Chinese imports has fundamentally altered the economics that have driven global manufacturing decisions for decades [1]. While these escalating tariffs may fluctuate amid ongoing trade negotiations, the underlying shift in global trade dynamics appears set to continue. For companies like Richtech Robotics—where our flagship ADAM and Scorpion robot systems are proudly assembled at our Las Vegas headquarters with critical American-engineered control systems and NVIDIA-powered operating platforms—this dramatic realignment creates a substantial strategic advantage. We believe our commitment to American manufacturing, combined with our integrated domestic supply chain for essential technology components, significantly minimizes our exposure to the extreme tariff environment while reinforcing our position as a leader in U.S. robotics innovation.

Why American Manufacturing Suddenly Makes Even More Sense

For years, conventional wisdom held that offshore manufacturing was the only economically viable approach for complex robotics systems. Today, the market is catching up to a different perspective.

Our manufacturing strategy—prioritizing American production and local sourcing—represents a strategic edge that delivers several distinct benefits:

- Minimal exposure to tariffs on imported parts, as many components are sourced domestically.

- In our experience, closer control over the production process enables faster iteration, higher quality control, and more responsive customer service.

- Customer feedback indicates that "Made in America" serves as a marketing advantage that appeals to customers prioritizing domestic production.

For Richtech Robotics, our proactive manufacturing and supply chain strategies are already paying dividends. With the implementation of these sweeping tariffs, our internal analysis anticipates our cost increases to just 1-5%, compared to potentially 125% for fully imported systems. This advantageous position stems from our comprehensive mitigation strategy: negotiating more favorable terms with suppliers, optimizing logistics partnerships to reduce shipping costs, strategically increasing domestic sourcing, and continuously expanding our U.S.-based assembly capabilities.

The financial calculus has shifted dramatically. While all manufacturers face challenges in the current environment, a predominantly American supply chain provides a powerful buffer against the harshest effects of the new tariff structure.

The Tariff-Driven Automation Boom

Here's the kicker that has investors buzzing: These tariffs are reshaping where robots are built and dramatically increasing the number of robots businesses need.

"High tariffs will force U.S. manufacturers to produce goods at a lower cost, which would be achieved through automation," notes an industry analysis from CNBC [2]. This isn't speculation—it's economic necessity. When faced with substantially higher costs for imported goods and components, companies must find ways to cut production expenses.

The solution? Robots—lots of them.

This new economic paradigm creates a virtuous cycle (a self-reinforcing loop of positive effects) for robotics manufacturers like Richtech. These massive tariffs—now expected to be at 125% for Chinese imports—could make our locally sourced and assembled robots dramatically more price-competitive against imported alternatives while simultaneously increasing overall demand for automation solutions across virtually every industry sector looking to control costs [2]. Even if future negotiations reduce these rates, the fundamental advantage for American manufacturing appears likely to persist.

The Global Supply Chain Challenge

The broader robotics industry now faces unprecedented challenges navigating this new landscape. For decades, the global robotics arena has been dominated by Japanese and European companies such as FANUC, Yaskawa, Kawasaki, ABB, and Kuka.

Industry analysts report that Japanese and European manufacturers represent a significant majority of the global installed base of industrial robots. These industry leaders built their manufacturing strategies around global supply chains, with significant production capacity in China. ABB, which describes itself as "China's #1 robotics manufacturer," began constructing a new factory near Shanghai in 2019, investing $150 million to build what it calls "the most advanced, automated and flexible factory in the robotics industry worldwide—a center where robots make robots" [3].

This approach made perfect sense in a low-tariff environment, especially given that China has emerged as a leading market for industrial robots over the past decade, according to industry research [4]. But the new shift in tariff policy changes everything [1].

The Physical AI Revolution Meets Economic Reality

Technology has finally gone from an empty promise to "Holy cow! It actually works!" In our assessment, the convergence of advanced AI and physical robotics systems represents a paradigm shift that will significantly transform manufacturing and service industries.

The question isn't whether the robotics revolution will happen, but who will lead it and from where. From our perspective, American companies manufacturing domestically appear increasingly well-positioned to lead this transformation [5].

This new economic landscape will accelerate several key trends:

Reshoring and Nearshoring

The trend toward relocating manufacturing operations to the United States or bringing them closer to Mexico and Canada was already gaining momentum before the latest tariff announcement. From our industry observations, companies across industries have been reevaluating their global manufacturing footprints in response to supply chain disruptions during the pandemic, geopolitical tensions, and concerns about intellectual property protection.

The new tariff structure adds powerful economic incentives to this existing trend. For robotics companies, reshoring manufacturing operations to the United States offers strategic supply chain benefits and significant cost advantages when serving the American market [1].

Innovation in Manufacturing Processes

The higher cost structure imposed by tariffs are expected to push robotics manufacturers to innovate in their production processes. Ironically, this may accelerate the adoption of automation within robotics manufacturing, as companies seek to offset higher component costs by increasing efficiency [2].

Yes, the robotics industry will now use more robots to build more robots. This virtuous cycle could reshape American manufacturing for decades to come [2].

The America-First Advantage in Robotics

What's particularly striking is how market forces are now validating strategic decisions to manufacture domestically. Many organizations have followed similar paths—companies like Productive Robotics, Boston Dynamics, and USABotics have all chosen to prioritize American manufacturing [5].

They share several common strategies that underpin their success:

- Focus on innovation and unique capabilities: Rather than competing directly with mass-market robots from global manufacturers, many successful American robotics companies carve out specialized niches where unique technical capabilities command premium pricing.

- Emphasis on ease of use and integration: These companies make simplicity and accessibility central to their value proposition, designing robots that require minimal programming expertise for effective deployment [2].

- Leveraging proximity to customers: American production allows for faster delivery, more responsive service, and closer collaboration with customers—advantages that can outweigh pure manufacturing cost differentials.

Real-World Impact: ADAM Delivering Results in High-Cost Labor Markets

At Richtech Robotics, these advantages are evident daily in our ADAM robot. This AI-powered service robot handles everything from bartending to barista duties and is assembled in our Las Vegas facility.

The benefits extend beyond cost savings for companies like One Kitchen, which deployed ADAM in its Walmart location in Rockford, Illinois. When a minor calibration issue arose last month, our technicians could address it within hours—not the weeks it might have taken with an overseas manufacturer.

Our experience with clients like Clouffee & Tea in Las Vegas demonstrates ADAM's transformative potential. According to our case analysis, after implementing ADAM, this client reported significant operational improvements, including labor efficiency gains, while maintaining service quality standards. This impact is particularly significant in markets like Los Angeles, where restaurant labor costs have become the largest source of financial strain for 38% of operators [6].

The timing couldn't be better. California's fast-food minimum wage is now $20 per hour, potentially rising to $20.70 [7]. In addition, Los Angeles restaurants are seeing food service workers' wages increase by 4.8% year over year [8]. Thus, automation solutions have become not just attractive but essential for survival. Industry reports show that only about one-third of restaurants in California hit their labor cost targets, with 44% spending more than planned [9].

Robots Building the Future, Right Here in America

The tariff-transformed landscape points toward an exciting future with enormous promise for investors. The global robotics market is projected to reach a staggering $283 billion by 2032, growing at nearly 15% CAGR [4]. That's not just impressive; it's transformative on a scale few technologies ever achieve.

But this moment is extraordinary because "American manufacturers and companies exporting to the U.S. will be forced to accelerate automation to remain competitive in this new tariff environment" [2]. Economists call this a "double-demand shock," where demand simultaneously skyrockets from domestic and international markets.

Our financial leadership anticipates that these policies—even if modified through future negotiations—will accelerate the reshoring of manufacturing to America, creating significantly increased demand for automation solutions that enhance production efficiency [4]. The current 125% tariff rate represents an extreme case, but even more moderate tariffs would maintain many of these advantages for domestic manufacturers.

Companies like Richtech—already positioned with the domestic manufacturing industry—aren't just avoiding tariff impacts; we're well positioned to capitalize on this unprecedented surge in automation demand. This convergence of market factors presents significant opportunities for companies with established domestic manufacturing capabilities.

Under the new tariff structure, American robotics manufacturing looks increasingly positive in the long run. As domestic production scales, economies of scale will improve, creating virtuous cycles of greater competitiveness, higher volumes, and further cost reductions. This could strengthen America's position in the global robotics industry, reversing decades of manufacturing migration to Asia and sparking new opportunities for innovation and growth at home.

Beyond Business: The Human Promise of Robotics

The ultimate goal of robotics isn't just building better machines—it's about unleashing human potential. By deploying service robots to handle routine tasks, we free people to create, innovate, empathize, strategize, and connect—the things that make us uniquely human [14].

The economic case for robotics has always been compelling. Now, with the convergence of technological breakthroughs and economic policy, we view the human case for American-made robotics as nothing short of revolutionary. This isn't just about sidestepping tariffs; it's about building a more resilient, innovative, and human-centered technological future powered by Physical AI that's proudly made in America [5].

References

[1] SupplyChainBrain. "Trump Kicks Off Global Trade War with Sweeping Tariffs." SupplyChainBrain, April 2, 2025.

[2] CNBC. "Robotics, Automation Will Thrive Under New Trade Tariffs." CNBC, July 2018.

[3] ABB. "ABB to Build the World's Most Advanced Robotics Factory in Shanghai." Business Wire, October 27, 2018.

[4] Precedence Research. "Robotics Market Size to Hit Around USD 283.19 Billion by 2032." GlobalNewswire, March 2023.

[5] Design News. "The Coming Impact of Tariffs, AI, & Sustainability on Supply Chains." Design News, April 3, 2025.

[6] Cuboh. "Key L.A. Restaurant Industry Statistics & Outliers." Cuboh, January 2025.

[7] Reuters. "California Could Bump Fast-Food Minimum Wage to $20.70." Reuters, February 2025.

[8] U.S. Bureau of Labor Statistics. "Consumer Price Index, Los Angeles area — February 2025." BLS, March 2025.

[9] 7shifts. "Restaurant Workforce Report 2025." 7shifts, January 2025.